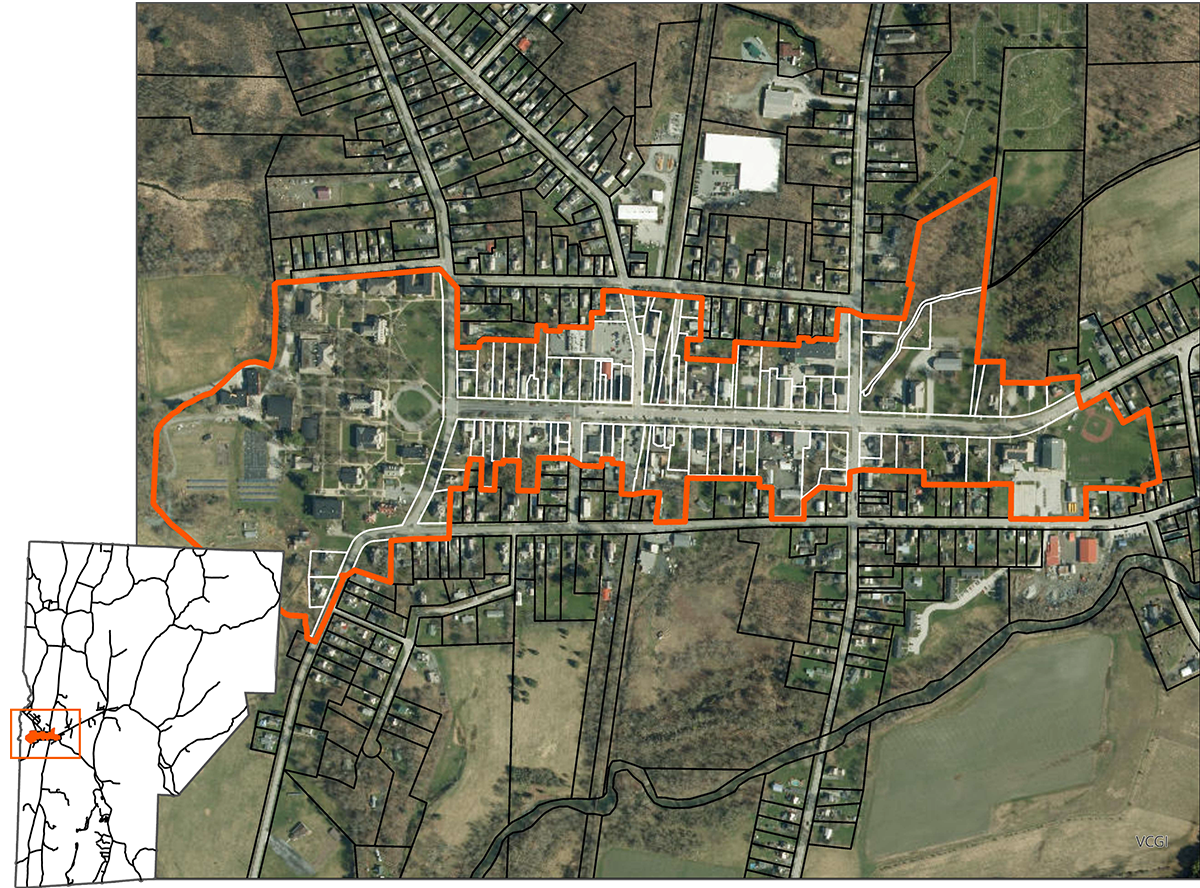

Are you a property owner in Downtown Poultney or East Poultney Village Center?

Your historic building could qualify for significant financial incentives through Vermont’s Downtown and Village Center Tax Credit Program. These credits help cover the costs of improving, restoring, or rehabilitating your property, enhancing our community and preserving local heritage.

Is Your Project Eligible?

- Building must be at least 30 years old

- Commercial, rental housing, or nonprofit-owned buildings qualify (single-family residences do not)

- Minimum project cost: $5,000

- Located in Poultney’s Designated Downtown or East Poultney Village Center

- Project may be underway (but not completed) when you apply

What Tax Credits Are Available for Your Project?

Flood Mitigation (50% Tax Credit)

- For improvements aimed at reducing flood risk

- Up to $75,000

-

System Relocation: Move HVAC, electrical, plumbing, and other critical systems above flood levels.

-

Structural Modifications: Elevate or floodproof foundations and lower-level walls.

-

Flood Barriers: Install walls, shields, or barriers to protect openings and vulnerable areas.

-

Drainage Improvements: Improve grading, add sump pumps, or enhance drainage systems.

-

Flood-Resistant Materials: Use water-resistant materials in flood-prone areas

Façade Improvements (25% Tax Credit)

- Exterior repairs and/or improvements to the front (public) façade of a qualified building

- Up to $100,000 in eligible costs for a maximum of $25,000 in credits is available

- Projects eligible for the 10% historic credit below are ineligible for façade credits

-

Architectural Features: Restore or replicate original details (cornices, brackets, moldings).

-

Windows & Doors: Repair or replace to maintain historic character.

-

Masonry: Repoint brickwork, repair stone facades, historically appropriate painting.

-

Storefronts: Restore or rebuild historic storefront elements (windows, entrances, signage).

-

Awnings & Canopies: Install or restore historically accurate awnings.

-

Non-Historic Material Removal: Remove modern cladding or siding to expose original materials.

Elevator/Sprinkler Credits (50% Tax Credit)

- Brings buildings up to modern safety and accessibility codes

-

Installation or upgrades of elevators (up to $75,000), LULA elevators (up to $60,000), and platform lifts (up to $12,000)

-

Sprinkler Systems: Installation or upgrades (up to $50,000)

Code Improvements (50% Tax Credit)

- Brings buildings up to modern safety and accessibility codes

- Up to $100,000 in eligible costs

-

Fire Prevention, Electrical, and Plumbing

-

ADA Accessibility Improvements

-

Hazard Abatement and Brownfield Mitigation

Historic Rehabilitation (10% Tax Credit)

- For substantial rehabilitation of certified historic buildings.

- Meets Secretary of the Interior’s Standards.

- Applies to the first $500,000 in project costs and half of additional costs beyond that amount.

-

Structural Repairs: Stabilize foundations, walls, and framing.

-

Exterior Work: Repair or replace roofs, siding, and gutters.

-

Windows & Doors: Restore or replicate to match historic character.

-

Interior Features: Restore historic stairs, moldings, and finishes.

-

Systems Upgrades: Modernize HVAC, electrical, and plumbing.

-

Accessibility: Add ADA-compliant features like ramps or elevators.

-

Hazard Abatement: Safely remove lead paint or asbestos.

-

Site Work: Improve drainage or landscaping without altering character.

Are You Ready To Apply?

Steps to Apply

- Contact Us: We will help determine if your project is eligible and schedule a visit with Vermont Agency of Commerce and Community Development staff

- Plan Your Project: Pull together budget information, “before” photographs

- Submit Application: Work with our team to submit your completed application to the State ahead of the deadline (August 1, 2025)

Contact Us Today

Provide some basic information to our team and we’ll help get your application underway!

Not ready yet? Let us remind you next year!

Tax credit applications are released on an annual basis! If the stars don’t align for your project this year, let us add you to our email database to receive an emailed reminder of the next round of credits.